BUSINESS & FINANCE

TruPS: Things you don’t know about it

The Federal Reserve Board of Governors allowed bank holding companies (BHCs) to utilize Trust Preferred Securities (TruPS) as Tier 1 core capital in 1996. This decision was applauded since it made it simpler for banks to obtain capital. However, since then, TruPS’s reputation has deteriorated from excellent to poor to nasty financial performance.

In 2000, a group of investors suggested pooling TruPS into CDOs with a subordinated liability structure. TruPS were “sliced” into “tranches” of equities and fixed-income instruments. By the ratings ranging from BB (greater risk) to AAA (least risk). The introduction of TruPS CDOs was a true “game-changer,” resulting in a significant rise in the number of TruPS issues as smaller banks were able to engage actively in the corporate securities market. This was all about TruPS CDOs.

In reaction to the financial crisis, regulators implemented several important regulatory changes in 2010. The necessity for banking institutions to have better capital levels to weather economic hardship is a major topic of these reforms. Trust preferred securities (TruPS) issued by Bank Holding Companies are one component of regulatory capital that has received much attention, debate, and, eventually, change in 2010. (BHCs).

What are TruPS?

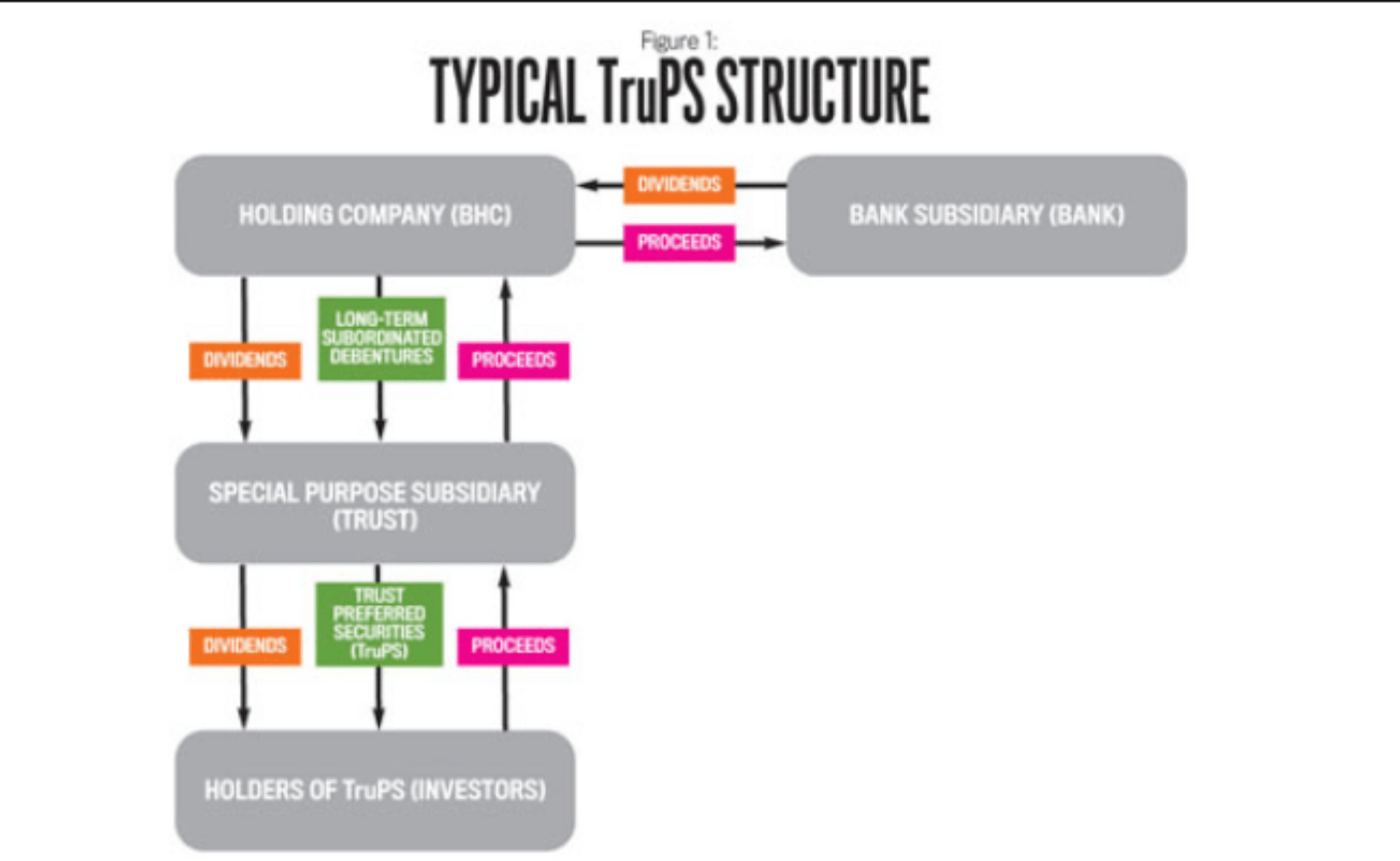

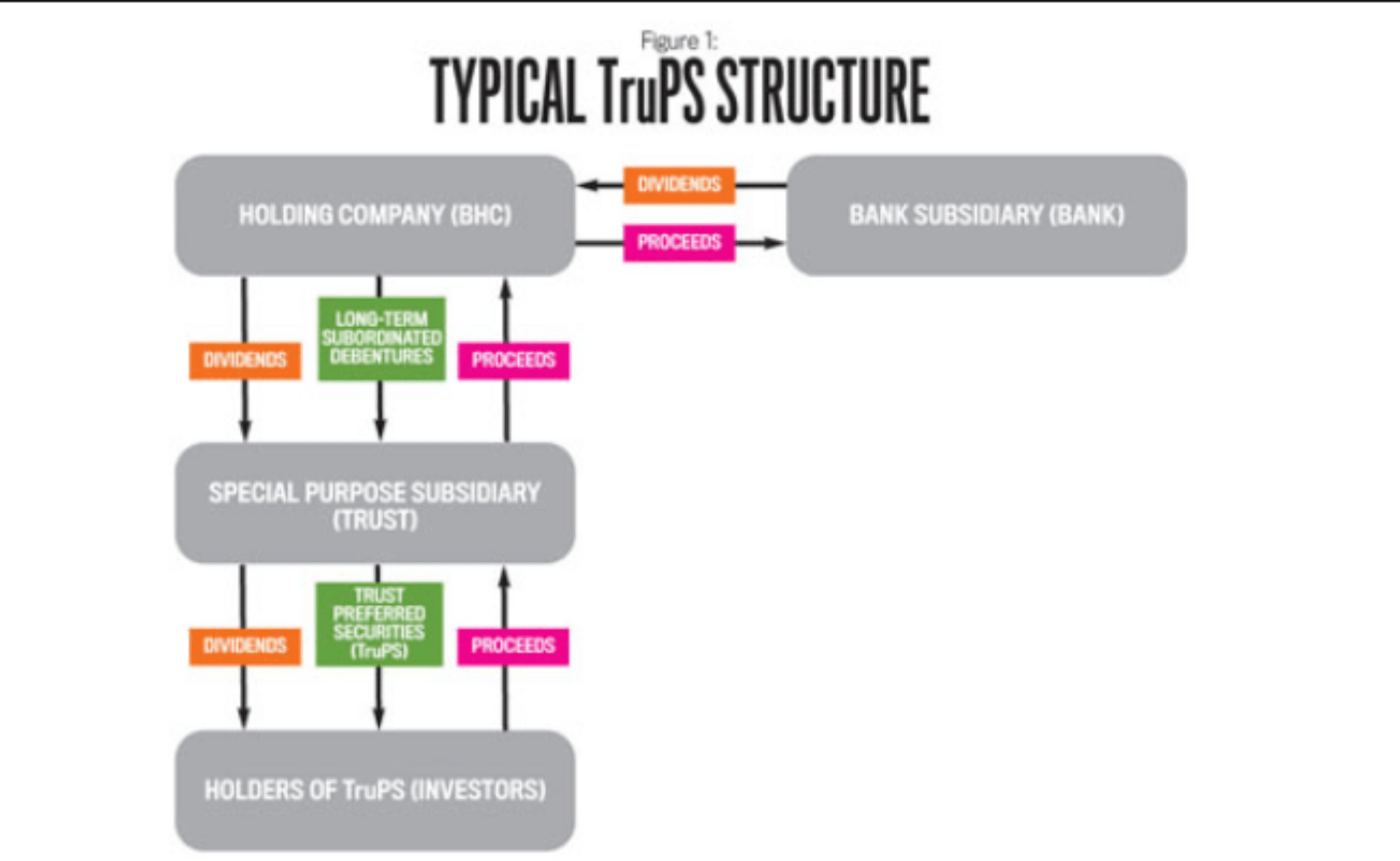

TruPS are a kind of hybrid instrument that combines loan and equity characteristics. A parent BHC establishes a trust subsidiary that issues TruPS, subsequently offered to investors in a conventional trust-preferred structure.

Following the 2008-09 financial crisis, TruPS, first issued in 1996, became the target of heightened regulatory scrutiny. However, most of these were phase out at the end of 2015 due to the Dodd-Frank regulations and the Volcker Rule.

The trust will utilize the profits from the sale to buy long-term debentures from the parent BHC. Which are debt securities that aren’t sponsor by tangible assets or security. The debentures’ terms must be identical to those of the TruPS and include a subordinated liability structure.

TruPS explained:

In other words, as compared to all other BHC debt, the debentures must be paid last—though the debentures do outrank equity in the payment pecking order. The proceeds from the debenture sale are subsequently transfer to the BHC’s operational bank to maintain the necessary minimum level of Tier 1 capital.

Quarterly payback payments are sent to investors after the trust subsidiary releases the TruPS. After that, the dividend is sent from the bank to the BHC, which goes to the trust and the investors.

They may provide a higher yield than corporate bonds or trust preferred stock, which makes them appealing to certain investors. Their maturities are also longer, providing investors with the opportunity to earn significant long-term returns. Trups may be bought from any broker.

In the case of bankruptcy:

In the case of bankruptcy, they are usually subordinate to ordinary debt, which explains why they have high yields.

However, the dangers are significant. For one thing, issuers are permit to make certain payments late. TruPS are senior to conventional prefer and ordinary stock, but they are subordinates to the issuer’s other debt. They are callable, which means the issuer may purchase them back, but this does not always imply a loss.

The Dodd-Frank financial reform law altered how most bigger banks may handle this debt; it no longer counts against a bank’s regulatory capital requirements. As a result, experts predict that more banks will seek to call these securities, making it riskier to purchase those trading at a premium to the issue price.

It may be difficult for an investor to sell a trust preferred asset to find an active market, lowering possible prices.

When banks were permit to issue Trups in 1996. They view them as a means to generate cash while still meeting their regulatory capital requirements rapidly. However, unlike premiumor prefer shares, interest paid on Trups was tax-deductible, much like ordinary debt, making them a win-win situation for banks.

However, interest has fallen due to the 2008 financial crisis, which saw several large banks fail, leaving investors cautious.

Why are TruPS appealing?

TruPS is appealing since the dividend payments to the BHC are tax-deductible. In addition, TruPS is an attractive financing vehicle since BHCs are permit to consider premium payments as if they were debt payments.

Debt has a lower funding cost than equity. The BHCs may delay paying dividends under TruPS for up to five years without causing a default, which is less appealing for TruPS investors.

On the corporate debt market, large financial institutions were first the issuers and buyers of TruPS. Because of their relatively limited investment offers, community banks were unable to attract big institutional investors. Furthermore, big institutional investors could put TruPS on the market at a lower cost than community banks due to economies of scale.

Some of the main features of TruPS:

• Trust preferred securities were a kind of bank-issued instrument with both debt and equity features. However, they were mainly phase out after the 2008-09 financial crisis due to legal and regulatory action.

- TruPS are shares of trust prefer stock that banks or bank holding companies issue by issuing debt.

- The trust prefer security typically provides a larger monthly payment than preferred stock and may have a term of up to 30 years.

- The cost of TruPS is a disadvantage for the issuer since investors expect greater returns for investments with provisions such as deferred interest payments or early redemption.

What do you need to know about Trust Preferred Securities (TruPS)?

The trust preferred security has both stock and debt features. Even though the trust is finance with debt. The shares issue are treat as prefers stock and pay dividends accordingly. However, the payments the investors get are interest payments and are tax. As such by the IRS since the trust retains the bank’s debt as the financing vehicle.

Due to the lengthy maturity schedule of the debt used to finance the trust, the trust preferred security typically provides a larger monthly payment than a share of prefer stock and may have a maturity of up to 30 years. Stockholder payments may be made on a set or variable basis.

Furthermore, certain clauses in trust securities allow interest payments to be defer for up to five years. The TruPS matures at face value at the end of the term, but the issuer has the option to redeem it early if they so choose.

Companies have developed trust preferred securities because of their advantageous accounting treatments and flexibility. According to GAAP standards, the Internal Revenue Service taxes these securities as debt obligations while preserving stocks’ appearance in a company’s financial statements.

The trust receives tax-deductible interest payments from the issuing bank. Which are disperse to the trust’s shareholders. Thus, when an investor purchases a trust preferred security, they purchase a part of the trust and its underlying assets, not a share of ownership in the bank.

Special considerations:

The Dodd-Frank financial reform legislation, enacted in 2010, contain a provision that state by 2013, trust securities issue by institutions with more than $15 billion in assets would no longer be eligible for Tier 1 capital classification.

Tier 1 capital treatment implies that money infuse in trust prefer securities may be include against a bank’s Tier 1 capital ratio. Which is the amount of money kept on hand to cover bad debt losses.

Banks’ funding needs will rise when trust prefer securities lists are phase out or exclude from the Tier 1 capital ratio, decreasing the number of incentives for banks to issue trust prefers the securities lists in certain instances.

In the United States Senate, the so-called “Collins Amendment” was suggest to eliminate trust prefers securities. As Tier 1 regulatory capital. Finally, since trust prefer securities often include characteristics such as postpone interest payments. Early redemption of shares, expenses are one of the drawbacks for businesses issuing them.

These characteristics make trust preferred securities less appealing to investors. As a result, rates on trust prefer securities are usually higher than rates on other kinds of debt. Simply because investors expect a better rate of return. Investment banking fees for underwriting securities may also be very costly.

Conclusion:

Organizations took full use of the ability to issue subordinated debt as tier 1 capital. Improving ROEs and increasing financial leverage via tax-deductible dividends. Financially weaker institutions that depended on TruPS for regulatory capital. Which took greater risks and failed more often than those that did not. Reforms were put in place to address identify the issues, as is frequently the case after a crisis. One example is the removal of TruPS from big BHCs’ tier 1 capital. As approved by the Basel Committee and mandated by the US Congress. Most institutions will find it doable to move away from dependence on TruPS and toward genuine loss-absorbing capital.