BUSINESS & FINANCE

Save Your Money! Why Writing Your Own ERP Is a Terrible Idea!

Write your own ERP? Are you Crazy!

I have been in the ERP space for many years, and I have had more than a few customers tell me that they had written their own ERP or they wanted to.

I sell Microsoft Dynamics, so you may say that I have a vested interest in discouraging this. It is bad for business if customers go write their own! Well that is true in a way. It’s bad for the customer’s business for sure.

There are more than enough customers who need ERP systems (especially cloud ERP like we sell) that one more ERP sale would make a huge difference to my business.

I wrote about this years ago with my article (here on Ezines) about ERP vs Microsoft Access. This is an updated version.

Read More:

https://latinosdelmundo.com/blog/pre-movie-supernatural-creature-bridge

https://latinosdelmundo.com/blog/dive-in-movies-video-of-supernatural-creature

https://latinosdelmundo.com/blog/outdoor-movies-supernatural-creature-walking-on-bridge-reddit

https://latinosdelmundo.com/blog/extra-extra-sublimation-ink-printer

https://latinosdelmundo.com/blog/collecting-a-vast-sublimation-printers

The 2 Reasons People Try and Write an ERP

One: They had a bad experience before and feel like they need control over their ERP. The idea of creating their own seems less risky that picking another bad ERP.

Two: They think ERP is to expensive and they can write their own more cheaply.

Let’s deal with reason 2 first.

Writing your own ERP is not cheap!

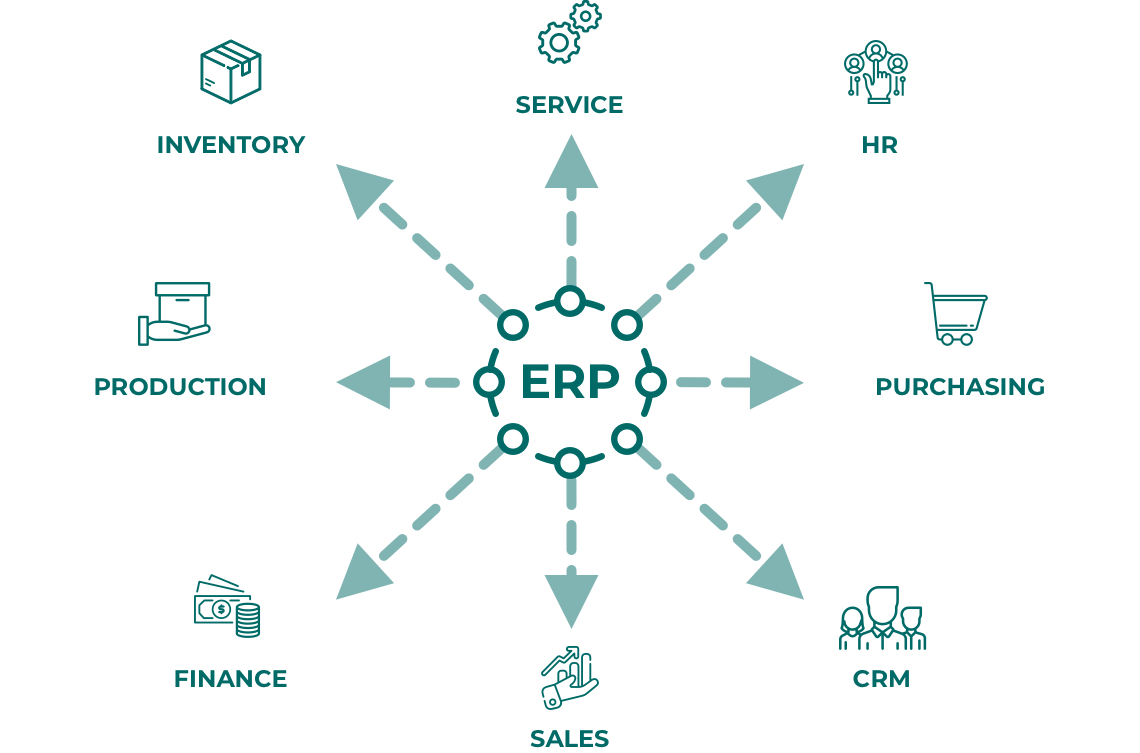

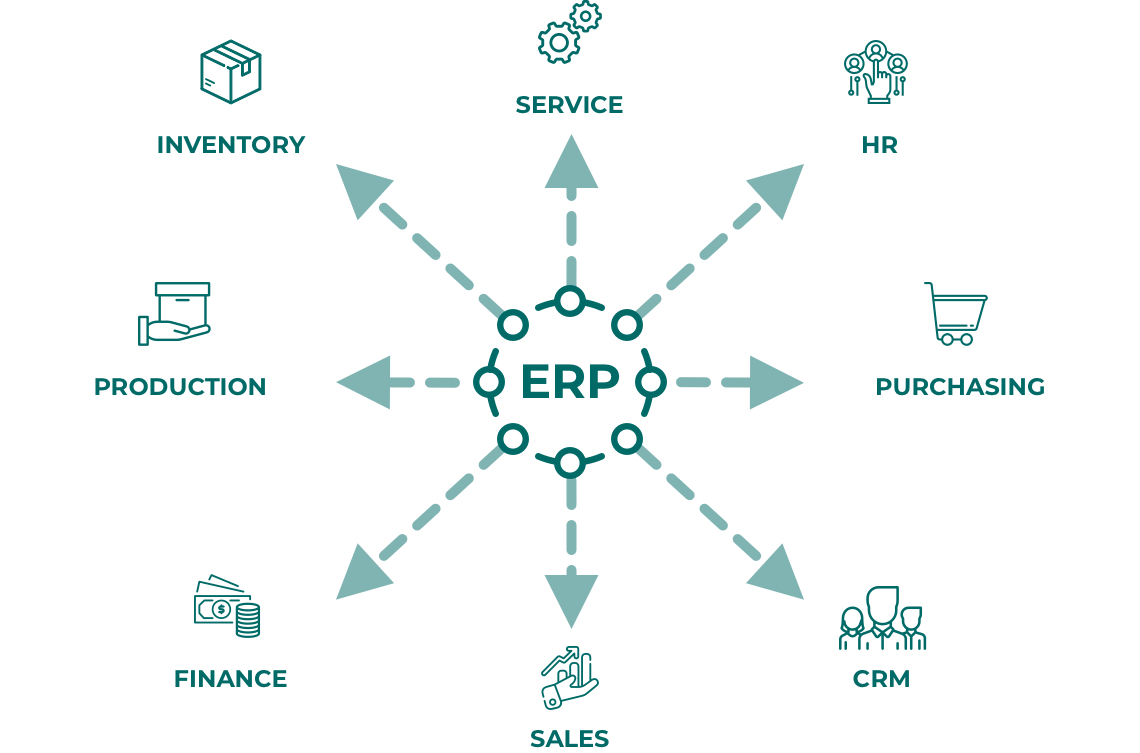

ERP systems are built from 1000s and 1000s of hours of programming. I don’t think most small businesses really appreciate this. Many hours of programming effort needs to go into building a system.

Even really basic MRP systems would take 2 to 3 “man years” of effort to build out to be usable.

An average ERP implementation in a small or medium business takes about 800 to 1000 hours. That’s your staff time (about half that of the consultants).

To write your own good ERP, you need a programmer.

Let’s use $80,000 a year as a salary. That is a VERY modest salary plus benefits for a programmer. You are either not getting a great developer (if they were great they’d be working at Google) or someone has no idea what they are worth.

To be realistic, it will take 3 man years of effort to build the ERP.

That is $240,000. You can get a really good ERP delivered and installed for $240,000.

Isn’t it Cheaper than a regular ERP Implementation in the long run?

Let’s take Dynamics Business Central as an example – since I know that really well.

No – it’s not.

I’ll post a link to a Dynamics 365 ERP pricing guide at the bottom of this post. Let’s consider a more or less “average” small or medium manufacturing company.

Implementing something like Business Central is going to be in the:

- $2000-$3000 a month for the software

- Maybe $100,000 for the implementation.

- It will take about 6 to 8 months to do.

Your home made ERP won’t be usable for at least a year. Maybe two. You might have some incremental capabilities, but 80% or more of your team will still be using manual systems for a minimum of 12 months.

The reason you need an ERP is to get away from Excel sheet hell and manual processes.

There are even less costly ERP systems like Oodo, but whether you choose Dynamics Business Central (which is cloud based and starts at $70 a month per user) or Oodo which has a weird price model I have yet to really understand – you need a lot of users to break even on the $240,000.

Your ERP Never Stops Costing you Money

The trouble is you own your ERP system. You break it, you fix it. You can never fire your $80,000 a year programmer. You must have them because they are the only source of technical support you will ever have.

And there will be an endless list of requests. They exist because you are writing your own ERP. The vast majority of employee wish lists will exist in any out of the box system you were to get. Your DIY ERP system will not have any of those features to start. So you are paying your $80,000 a year staff member to write them one by one.

Flexibility and Customization

The second reason that people want to write their own ERP is because they have a bad experience the first time. This leads them to distrust the ERP process and feel like they’re better off writing their own.

This is what I wrote in the original article about creating a DIY ERP system in Microsoft Access.

Soon after your database is created and your purchase orders are going out to vendors, you realize you need to receive things. Vendors are annoying, sometimes they ship exactly what you wanted, in exactly the quantity and at the price on the PO – but often they don’t. So as time passes the simple access database begins an insidious march towards something deadly – COMPLEXITY!As time goes on it gets more and more complicated.

Read More:

https://latinosdelmundo.com/blog/what-are-some-of-heat-press-nation

https://latinosdelmundo.com/blog/where-can-i-purchase-printer-for-sublimation

https://latinosdelmundo.com/blog/Top+Signs+That+invincible+season+2+release+date

https://www.exoltech.us/blogs/933/Today-s-Internet-Era-ethernet-splitter

https://www.exoltech.us/blogs/934/How-Does-It-ethernet-cable-splitter-work

Find an ERP you can Customize Yourself

So what to do about this? You really do not want to be backed into a corner where you don’t have options.

Get an open source ERP of course.

Open source means that you can modify and customize the ERP yourself. The source code of the ERP system is available for a programmer to make changes. There are two models of open source. The free open source (nothing is ever really free) and the commercial open source.

Microsoft Dynamics Business Central – Commercial Open Source

Microsoft Dynamics Business Central is actually more of a ERP programming language than it is an ERP. It is written in a newly modernized language called AL – which is constantly being enhanced. This is derived from the old Microsoft Dynamics NAV C/AL language.

We’ve had a few customers learn the AL language. They have done this almost entirely on their own. Within a few weeks the were writing code in it.

It is not hard to learn and not hard to code in. It would be WAY less costly to start with a finished ERP and enhance it. Your alternative is to start with a blank page and spend 6000+ hours programming. Then you might have something super cool and totally unique and very, very expensive!

Conclusion

Get a real ERP system like Microsoft Dynamics Business Central. The effort you need to creat your own full featured ERP will be shocking. Get a “seed” ERP system that you can modify.

You will never save money writing your own system.

You’ll either provide a job for life to a programmer or you’ll end up like a lot of customers. With a barely working mess that you replace anyway.